Transaction Advisory Services Things To Know Before You Buy

An Unbiased View of Transaction Advisory Services

Table of ContentsTransaction Advisory Services for DummiesLittle Known Facts About Transaction Advisory Services.The 4-Minute Rule for Transaction Advisory ServicesHow Transaction Advisory Services can Save You Time, Stress, and Money.Fascination About Transaction Advisory Services

This action sees to it business looks its best to prospective buyers. Getting business's worth right is vital for a successful sale. Advisors use various methods, like affordable cash money flow (DCF) analysis, comparing with similar business, and current transactions, to determine the reasonable market price. This assists establish a reasonable price and discuss successfully with future buyers.Transaction consultants action in to assist by getting all the needed information arranged, addressing inquiries from buyers, and organizing sees to business's location. This constructs count on with buyers and maintains the sale moving along. Obtaining the most effective terms is essential. Transaction experts utilize their experience to assist company owner deal with difficult arrangements, meet purchaser assumptions, and framework bargains that match the proprietor's objectives.

Satisfying legal policies is crucial in any type of organization sale. Purchase consultatory services deal with legal professionals to create and examine contracts, agreements, and other lawful documents. This reduces threats and sees to it the sale adheres to the law. The function of purchase experts expands past the sale. They aid entrepreneur in intending for their following steps, whether it's retirement, beginning a new venture, or handling their newly found wide range.

Purchase consultants bring a wealth of experience and understanding, making sure that every aspect of the sale is dealt with properly. With strategic preparation, valuation, and negotiation, TAS assists entrepreneur achieve the highest possible price. By ensuring lawful and regulative conformity and managing due persistance together with various other deal employee, purchase advisors minimize possible risks and liabilities.

Transaction Advisory Services Fundamentals Explained

By comparison, Large 4 TS groups: Work on (e.g., when a possible purchaser is conducting due diligence, or when a deal is closing and the customer needs to incorporate the firm and re-value the vendor's Annual report). Are with fees that are not linked to the offer closing effectively. Make charges per engagement somewhere in the, which is less than what investment financial institutions gain also on "tiny deals" (however the collection probability is additionally much greater).

The interview concerns are really similar to financial investment financial meeting concerns, but they'll concentrate much more on accountancy and valuation and much less on topics like LBO modeling. Anticipate questions regarding what the Adjustment in Working Resources ways, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional only" topics like test balances and exactly how to walk through events utilizing debits and credit histories rather than economic statement modifications.

Transaction Advisory Services for Dummies

that demonstrate how both metrics have transformed based upon products, channels, and customers. to evaluate the precision of management's past forecasts., including aging, inventory by item, typical levels, and provisions. to establish whether they're totally imaginary or somewhat believable. Specialists in the TS/ FDD groups may also interview administration regarding every little thing over, and they'll create an in-depth record with their searchings for at the end of the procedure.

The power structure in Deal Solutions varies a little bit from the ones in financial investment banking and personal equity professions, and the general form appears like this: The entry-level function, where you do a great deal of information and monetary analysis (2 years for a promotion from right here). The next level up; comparable job, but you obtain the even more intriguing little bits (3 years for a promo).

In specific, it's difficult to obtain advertised beyond the Supervisor level since couple of people leave the job at that stage, and you require to begin showing proof of your ability to generate revenue to development. Allow's start with the hours and way of life since those are simpler to define:. There are occasional late evenings and weekend job, yet nothing like the frenzied nature of investment banking.

There are cost-of-living modifications, so expect reduced payment if you're in a cheaper location outside significant monetary (Transaction Advisory Services). For all placements except Companion, the base pay comprises the bulk of the complete payment; the year-end incentive could be a max of 30% of your base income. Frequently, the most effective method to increase your revenues is to switch to a various firm and discuss Click Here for a higher wage and perk

Rumored Buzz on Transaction Advisory Services

At this stage, you ought to just remain and make a run for a Partner-level role. If you desire to leave, maybe relocate to a client and perform their assessments and due diligence in-house.

The major issue is that because: You generally need to join an additional Huge 4 team, such as audit, and job there for a few years and then relocate go to these guys right into TS, work there for a few years and afterwards relocate right into IB. And there's still no assurance of winning this IB role since it relies on your area, clients, and the working with market at the time.

Longer-term, there is likewise some threat of and because examining a company's historic economic info is not precisely rocket scientific research. Yes, people will certainly always require to be entailed, yet with advanced modern technology, lower headcounts could potentially support customer interactions. That claimed, the Deal Providers team beats audit in regards to pay, work, and leave opportunities.

If you liked this short article, you could be curious about reading.

Fascination About Transaction Advisory Services

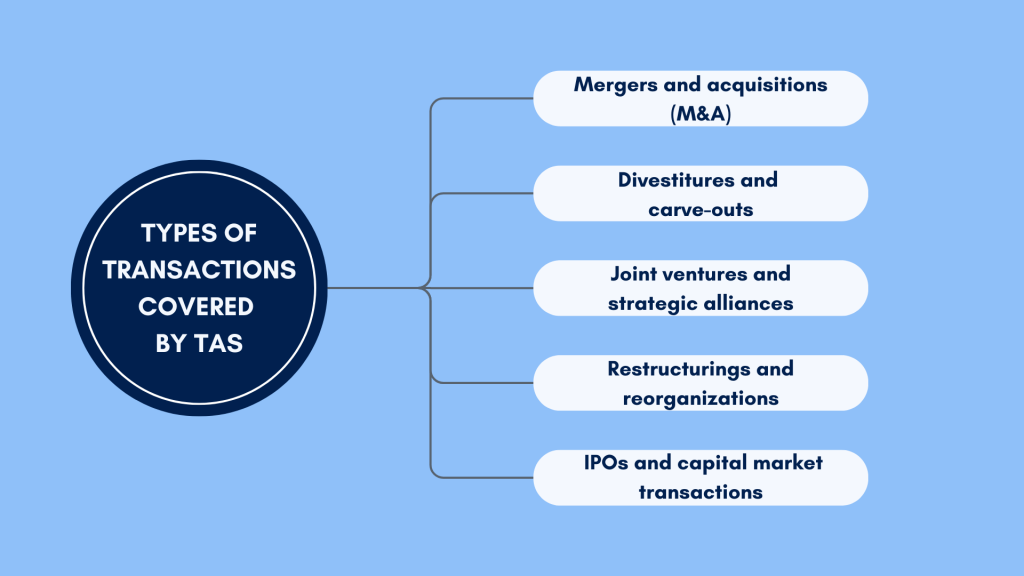

Develop advanced monetary frameworks that aid in determining the real market value of a company. Provide consultatory work in relationship to company evaluation to aid in bargaining and pricing structures. Describe the most suitable type of the bargain and the type of factor to consider to utilize (cash, supply, gain out, and others).

Do assimilation planning to identify the process, system, and business modifications that may be needed after the deal. Set guidelines for incorporating departments, innovations, and organization processes.

Analyze the potential customer base, market verticals, and sales cycle. The operational due diligence supplies vital understandings into the functioning of the firm home to be gotten concerning threat evaluation and worth development.